Debt recovery for small business involves hiring a collection agency that offers low cost products, delivers high recovery rates without damaging your business reputation. We are a highly-regarded collection agency, offering meticulously crafted services to help you recover the maximum amount from your outstanding bills. Serving thousands of businesses nationwide.

We offer free credit reporting, free bankruptcy screening and free skip tracing service. There is no joining fee, no minimums and no obligation to submit a minimum number of accounts annually. We also red-flag a debtor if we find he has the history of suing businesses like yours in the past. All accounts are managed through our secure online client portal.

Our Online Ratings

4.85 out of 5.01500+ Google reviews |

BBB RATING A+

|

Contact us to recover unpaid bills:

Service Options:

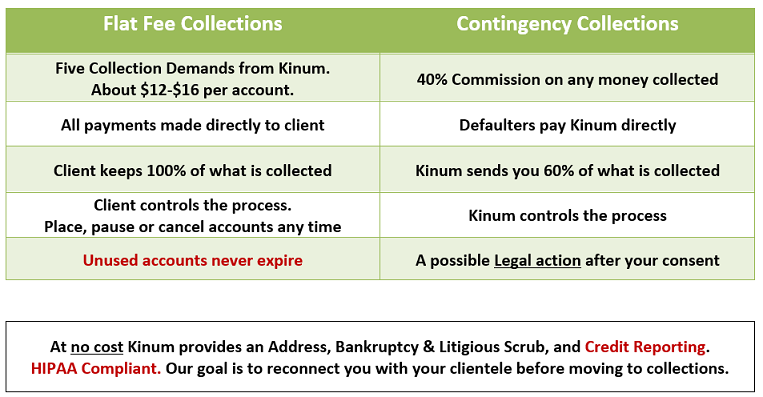

Option A: Fixed-Fee Collections – Written Legal Demands

This option requires purchasing a batch of accounts in advance. You retain 100% of all recovered funds. We send 5 attorney-approved written demands to your debtors under our name (1 account = 5 contacts). This method is most effective for bills less than 1 year past due. Unused accounts do not expire. After consulting with your accountant, most clients can typically write off this cost as a business expense on their taxes. Cost of each account varies from $10 to $27 per account depending on the accounts purchased. This service is perfect for small businesses who are looking for low cost recovery service.

Option B: Contingency Collections – Collection Calls

This option involves a professional debt collector making multiple calls to your debtor. There are no upfront fees. We only earn if we collect, retaining 40% of the recovered amount while you keep 60%. This service is advised for accounts aged between 120 days and 3 years, irrespective of the balance. Accounts can be further forwarded for Legal Collections after taking your approval.

Hiring us offers key benefits for businesses: it eases the burden on staff, cuts down on internal collection costs, and lets companies focus on customer relations, thereby improving operational efficiency and maintaining positive client relationships.