Are you tired of chasing unpaid invoices and struggling to maintain cash flow? CA-USA’s fixed-fee written demand service offers a cost-effective and efficient solution to recover your outstanding debts without the confrontation and hassle of traditional collection methods like debt collector calls and legal action.

Our fixed-fee written demand service offers a powerful, cost-effective, and legally compliant solution to recover your outstanding debts without sacrificing customer relationships. Fixed fee collection service is one of the reason why our clients ( and even debtors), have rated us 4.8 out of 5 online with over 2000 reviews.

What are Fixed Fee Written Demands?

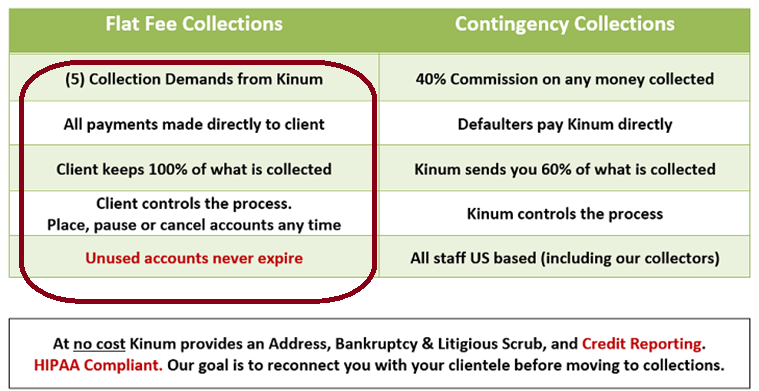

Our fixed-fee service consists of five professional demand letters sent directly to your debtor on our letterhead. This powerful approach clearly signals to the debtor that their account has been escalated to a collection agency, significantly increasing the likelihood of prompt payment. Clients pay directly to you, and accounts that remain unpaid can then be forwarded for intensive collections.

Why Choose CA-USA’s Fixed Fee Service?

- Faster Collections & Improved Cash Flow: The involvement of a collection agency often creates a sense of urgency and seriousness, leading to faster collections compared to when your own staff were trying to collect themselves. This translates to improved cash flow for your company.

- Amicable & Effective: Written demands are the most amicable way to collect money as there is no direct confrontation or embarrassment involved. This makes it easier to maintain relationships with your defaulting customers while still achieving results. At the same price, you can avail our Hybrid demand service offers an even gentler approach, starting with a reminder on your behalf, followed by four collection demands on our letterhead.

- Legal Compliance: We ensure all demands adhere to the Fair Debt Collection Practices Act (FDCPA) and other relevant laws, minimizing your legal risk.

- Accurate Delivery & USPS Address Checks: We perform USPS address checks to ensure demands reach the debtor’s most current address, maximizing the chances of successful delivery.

- Cost-Effective & Transparent: Written demands are a highly affordable alternative to traditional collection calls, especially for unresponsive debtors. Our fixed-fee model ensures complete transparency, with no hidden costs or surprises. You’ll always know exactly how much effort is being invested in collecting your debts.

- Unbeatable Value: At an average cost of $15 per account (for 100 accounts), our service includes printing, postage, and handling mail returns. This translates to roughly $3 per demand, offering significant savings compared to in-house collection efforts which include paper, printing, employee salary, time, infrastructure, and handling mail returns.

- Tax Benefits & Additional Features: In most cases, the entire cost of our fixed-fee service is tax-deductible as a business expense. We also offer demands in English and Spanish and verify bankruptcy status to ensure legal compliance.

- Focus on Your Business: Outsourcing collections to CA-USA. allows you to concentrate on your core business operations without the distraction of debt collection efforts.

- Early Intervention & Reputation Management: Ideal for accounts less than 6 months old, early intervention with formal demands can prevent debts from escalating and requiring more aggressive collection tactics later on. Using a third-party agency also demonstrates a professional and structured approach to managing overdue accounts, enhancing your business reputation.

Take Control of Your Collections

Fixed-fee services are highly effective for medical practices, small businesses, financial institutions, educational organizations, and even large commercial clients.

Contact us today to learn more about how we can help you improve your cash flow and focus on what matters most – growing your business